Automotive Parts Aftermarket

Global Aftermarket Study on Automotive Parts: Rising Vehicle Parc and Preventive Maintenance to Aid Market Expansion

Automotive Parts Aftermarket Segmented By Engine & Transmission Parts, Brake Parts, Electrical Parts, Fuel Intake & Ignition Parts, A/C Parts, Suspension Parts, Exhaust Parts, Engine Cooling Parts, Steering Parts, Wheels, Tires Product

- September-2021

- PMRREP32832

- 355 Pages

- beplay2官方网站地址

- PPT, PDF, WORD, EXCEL

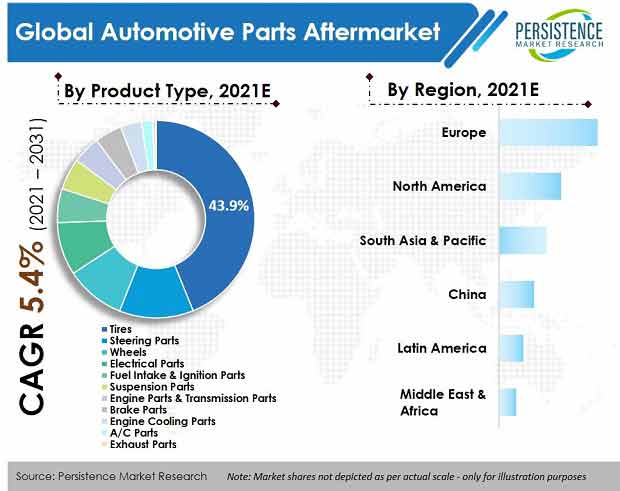

Market Snapshot

Persistence Market Research estimates that value sales of automotive parts would grow at a CAGR of around5.4%from 2021 to 2031 and top a valuation of US$ 883 Bn by 2031. Tier-1 firms such as Robert Bosch, Denso Corporation, Continental AG, ZF Friedrichshafen AG, and Tenneco Inc., who combined accounted for around6%of worldwide revenue in 2020, are among the top manufacturers of automotive parts in the aftermarket.

Find Out More about the Report Coverage

Companies

- Robert Bosch GmbH.

- ZF Friedrichshafen AG

- Hella KGaA Hueck & Co.

- NGK Spark Plug

- Exide Technologies

- Gabriel India Limited

- Hitachi Astemo, Ltd.

- KYB Corporation

- Tenneco, Inc.

- Denso Corporation

- Magna International

- Continental AG

- Valeo SA

- Bridgestone

- Michelin

- Goodyear

- Pirelli

- Mahle GmbH

- BorgWarner

- OSRAM Licht AG

- Knorr-Bremse

- Aisin Corporation

Automotive Parts Aftermarket Survey Also Addresses:

- Market Estimates and Forecasts (2016-2031)

- Key Drivers and Restraints Shaping Market Growth

- Segment-wise, Country-wise, and Region-wise Analysis

- Competition Mapping and Benchmarking

- Brand Share and Market Share Analysis

- Key Product Innovations and Regulatory Climate

- COVID-19 Impact on Demand for Automotive Parts and How to Navigate

- Recommendation on Key Winning Strategies

Customize this Report

Explore Intelligence Tailored to Your Business Goals.

Sales Analysis of Automotive Parts from 2016 to 2020 Vs Market Projections for 2021 to 2031

From 2016 to 2020, sales of automotive parts in the aftermarket increased at a1.2%CAGR, a slow growth rate because of massive production slowdowns in 2020 due to Covid-19. Countries such as China, the U.S., Germany, India, and Japan accounted for a large share of the global market.

The automotive industry is growing rapidly because of the introduction of new innovations, which is boosting the development of automotive parts. As a result, key participants are adjusting their methodologies to market trends to keep up with the intensity in a particularly dynamic environment. For instance, demand for automotive parts is anticipated to increase due to latest technology in car engine clutches.

Leading businesses are presently intending to utilizelightweight materialsto manufacture parts that are altogether lightweight and significantly more eco-friendly than their previous versions. Due to stricter ecological guidelines leading to substitutions in engine vehicles and their motors, the amount of scrap is higher in developed nations as compared to developing nations.

Essentially, in developed nations, utilization of new technology and innovations in engines, such as hybrid engines, is more prevalent than in developing nations, which is why Europe is projected have a larger market share.

Demand for producing new vehicles with decreased utilization of fuel is supported by increasing government support with moderately stricter emission norms, bringing about more demand for automotive parts. These factors are expected to help the development of the worldwide market for auto parts in the aftermarket.

With upgrades in materials and innovation utilized for vehicle producing, the average lifespan of vehicles has increased generously. The unwavering quality of vehicles has been essentially grown over the previous decade. Customers are progressively keeping old vehicles as their second vehicles instead of exchanging or scrapping them. Because of increased vehicle age, there is huge requirement for substitution of parts, repair, and maintenance, which is relied upon to drive the auto parts industry in the aftermarket.

Owing to the above mentioned factors, from 2021 to 2031, the global automotive parts aftermarket is predicted to rise at a CAGR of5.4%.

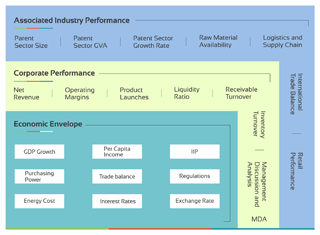

市場研究Methodology - Perfected through Years of Diligence

為我們的無與倫比的市場研究acc的一個關鍵因素uracy is our expert- and data-driven research methodologies. We combine an eclectic mix of experience, analytics, machine learning, and data science to develop research methodologies that result in a multi-dimensional, yet realistic analysis of a market.

What are the Key Opportunities on Offer for Automotive Part Manufacturers?

Growing demand forelectric vehiclesas a result of stricter emission standards for automobiles is expected to result in significant increase in electric vehicle sales around the world. Major automakers are working to extend their range of electric vehicles.

Increased adoption of electric vehicles has resulted from factors such as increased demand for fuel-efficient, high-performance, and low-emission vehicles, as well as strict government rules and regulations regarding vehicle emissions, creating new opportunities for auto part manufacturers in the aftermarket.

Adoption of EV-related auto parts will be slow in the aftermarket space initially, but with the industry seeing a paradigm shift, the rate is expected to increase considerably after some years.

Also, countries such India and ASEAN nations are set to offer huge opportunities for market players during the forecast period. Technical progressions, growing and developing manufacturing sector, and ideal demographics with a majority of the population being under 30 years are some of the factors powering the development of the automotive sector, leading to increased opportunities for automotive part manufacturers in the aftermarket.

Explore Persistence Market Research’s expertise in promulgation of the business !

What Restraints Do Automotive Part Suppliers Encounter?

Cost of products has shot up for most makers as a result of higher input costs, especially raw materials such as steel. Consistent rise in metal costs is set to raise raw material expenses for automakers and reverse the gains in margins gathered by companies in the past couple of years from benign commodity and energy costs.

Manufacturers encounter issues that cascade down the supply chain. They are still grappling with the two supply chain bottlenecks that plagued the industry during the pandemic: sluggish supplier deliveries and lower availability of labor, while costs continue to rise.

Organizations that make everything from bikes to heavy trucks have, as of now, raised prices a few times since April 2021 due to higher raw material costs. Economic situations are driving up costs of numerous raw materials, and right now, purchasers are barraged with cost increments across different items. These factors are expected to restrain market development over the coming years.

What is the Regulatory Impact on Global Sales of Automotive Parts?

The way automobiles look, how their components are designed, the safety features that are included, and the overall performance of any given vehicle are all influenced by government regulations in the automotive industry. As a result, these restrictions have a considerable impact on the automotive industry, boosting overall production costs while also restricting how car parts are sold and promoted.

Automobile regulations are intended to benefit consumers and safeguard the environment, and if they are not followed, automakers may face significant fines and other consequences. Many automobiles are built to comply with international rules as well as U.S. regulations.

Because many different criteria must be met for a vehicle to be street-legal in different regions of the world, this adds to the cost and slows down the design process.

Which Region Offers Lucrative Opportunity for Automotive Part Suppliers?

Europe is anticipated to be the most lucrative market for automotive part manufacturers and suppliers, expected to rise at a CAGR of6.1%. Germany is projected to hold nearly29%of the market share in Europe.

Germany has the highest number of automotive manufacturers in the world, which is one of the most important factors contributing to the growth of the market in the region. The number of passenger cars as well as light commercial vehicles has considerably grown in Europe since the past few years, which is one of the major drivers for the expansion of the automotive aftermarket in the region.

Country-wise Insights

Where Does the U.S. Stand in the Aftermarket for Automotive Parts?

The U.S. held around80.7%在2021年的北美市場份額。在the forecast period, the U.S. is expected to be one of the lucrative markets for aftermarket parts due to increase in vehicle production in the country as well as presence of tier-1 manufacturers.

Manufacturers in the U.S. are focusing on technological innovations for new product development or for upgrading existing products for aftermarket parts, which is also one of the major factors surging market growth in the U.S.

Why are Automotive Part Manufacturers Eyeing China?

China is the most popular profitable market for manufacturers and suppliers of automotive parts. This market is projected to be expanding at a CAGR of5.6%over the decade.

China is one of the most promising and highly growing automotive hubs because of growing number of on-road vehicles and also high presence of automotive aftermarket part manufacturers. Many manufacturers in China export their parts to countries all around the world.

Will the Aftermarket for Automotive Parts in Japan Continue to Remain Profitable?

Over the next ten years, the market in Japan is projected to rise at a CAGR of4.9%.Japan is considered one of the significant markets in the Asia region due to high production of automotive parts for OEMs as well as for the aftermarket.

日本製造商focusing on providing a wide range of components that are cost-effective as well as have a longer service life. They also focus on collaborations with other players in the automotive industry for higher technological standards, advanced manufacturing techniques, and development of advanced automotive technology for parts.

Category-wise Insights

Which Automotive Part Has the Most Potential for Growth in the Aftermarket?

The top product category for automotive parts is tires, which is predicted to account for41.9%market share by the end of 2031. The lifespan of a vehicle’s tire depends on the driver as well as the road conditions, but tires need to be replaced after 10 years as they can get damaged and can wear out, which affects the alignment of the vehicle.

Aftermarket sales for tires are increasing due to increase in disposable income of the population as well as rise in safety measures adopted by consumers, which is one of the crucial factors for the potential growth of the tire market over the coming years.

Will Aftermarket Sales of Automotive Parts Continue to Be Led by Passenger Cars?

The passenger car segment is projected to expand at a CAGR of5.3%and account for64%of the overall market in 2031. The average lifespan of a car is almost 12 years, which may vary depending on the use of the car and road conditions, as the car needs to be serviced regularly; this is accelerating the aftermarket for automotive parts.

Replacement parts for cars are available in repair shops as well as authorized dealership stores, which is increasing the sales of these parts in many regions. Parts for vehicles are also available on various e-Commerce websites, which is expanding the aftermarket for car parts across regions.

What Sales Channel Drive Most Demand for Automotive Parts?

Authorized dealers enjoy the most demand accounting for47.7%of the overall market in 2021.

Authorized dealers have a franchisee to sell OEM parts of a specific company. Number of authorized dealers is rising across regions due to growing preference of the population toward genuine replacement parts for vehicles.

Owners are spending considerable amounts on preventive measures and servicing of vehicles at authorized dealerships.

COVID-19 Crisis Impact

汽車工業是最糟糕的affec之一ted sectors by COVID-19 as production was completely stopped, which resulted in a decline of vehicle sales as well as plummeted sales of aftermarket components.

Many manufacturing facilities were completely shut down across regions due to lockdowns, which directly impacted the economy of most regions. Part manufacturers suffered losses due to decline in production and demand for automobiles. COVID-19 lockdowns kept people at home, which resulted in less use of vehicles, and impacted the businesses of vehicle repair shops and small scale garages as well.

The industry is slowly recovering from the losses of the pandemic, as many production facilities have resumed, which has resulted in positive sales figures in many regions. Various e-Commerce websites forspark plugs, suspension parts, brake parts, steering parts, tires, and others have also accelerated the sales of aftermarket parts.

Competitive Landscape

The global automotive parts aftermarket is competitive, with major players striving to acquire a large market share. Major firms are focusing on marketing and sales activities to maintain existing customers as well as acquire new customers to increase the sales of automotive parts.

Over the last few years, the aftermarket industry has seen a variety of growth strategies implemented by market players, including acquisitions, mergers, and partnerships. To increase their revenue share, industry participants are investing in research & development and introducing new products into the market for their customers.

Scope of Automotive Parts Industry Report

Attribute |

Details |

Forecast Period |

2021-2031 |

Historical Data Available for |

2016-2020 |

Market Analysis |

|

Key Regions Covered |

|

Key Countries Covered |

|

關鍵細分市場覆蓋 |

|

Key Companies Profiled |

|

Report Coverage |

|

Customization & Pricing |

Available upon Request |

Key Segments Covered in Automotive Parts Industry Research

Product

- Engine & Transmission Parts

- Pistons

- Piston Rings

- Oil Filters

- Oil Pumps

- Air Filters

- Clutch

- Transmission Filters

- Brake Parts

- Brake Pads

- Brake Calipers

- Brake Rotors

- Brake Shoes

- Brake Drums

- Electrical Parts

- Starters

- Alternators

- Batteries

- Light Bulbs

- Sensors

- Fuel Intake & Ignition Parts

- Fuel Filters

- Fuel Injectors

- Spark Plugs

- Glow Plugs

- Fuel Pumps

- A/C Parts

- Cabin Air Filters

- Compressors

- Condensers

- Blower Motors

- Suspension Parts

- Shock Absorbers

- Leaf Springs

- Coil Springs

- Air Springs

- Exhaust Parts

- Exhaust Pipes

- Mufflers

- Engine Cooling Parts

- Radiators

- Radiator Fans

- Intercoolers

- Water Pumps

- Steering Parts

- Wheels

- Tires

Vehicle

- Passenger Cars

- Light Commercial Vehicles

- Heavy Commercial Vehicles

- All-Terrain Vehicles

- Off-Highway Vehicles

Sales Channel

- Authorized Dealers

- Independent Dealers

- Online Channels

- FAQs -

The global automotive parts aftermarket is currently valued at over US$ 524 Bn.

Rising vehicle parc, increase in vehicle age, and rising penetration of e-Commerce channels are the main factors driving industry growth.

From 2016 to 2020, demand for automotive parts in the aftermarket increased at a CAGR of 1.2%.

Sales of automotive parts in the aftermarket are projected to increase at 5.4% CAGR and be valued at over US$ 883 Bn by 2031.

Growing preference toward preventive maintenance and growth of clean mobility are key trends shaping this space.

Robert Bosch, Denso Corporation, Continental AG, ZF Friedrichshafen AG, and Tenneco Inc. are the top 4 market players who account for 4% share.

The market in Germany is set to progress at around 5.8% CAGR through 2031.

The U.S., China, Germany, Mexico, and Japan are the major demand centers for automotive parts in the aftermarket.

The aftermarket for automotive parts in North America is slated to expand at 4.4% CAGR over the decade.

Japan and South Korea, together, hold around 7.4% share of the global market at present.

Recommendations

Our Clients